Digital Investment Platform: Complete Guide to Raising Funding Online in 2025

- 01 Dec 2025

Introduction

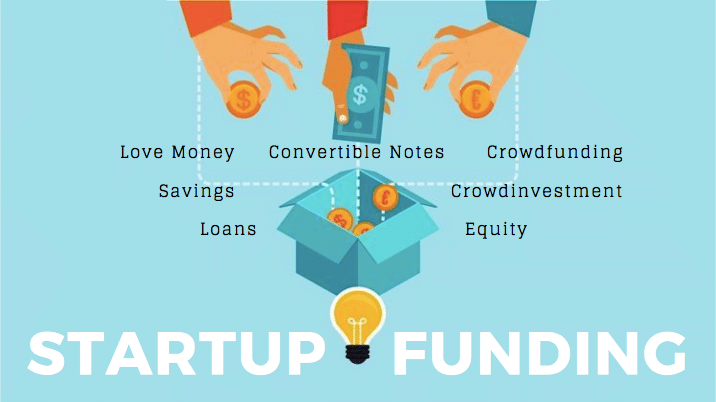

Digital Investment Platform adoption has exploded in 2025. Startups now raise funds faster with streamlined tools. This guide explains each step clearly. Founders seek clarity when they explore online capital. Many feel lost when they search for a reliable Online Fundraising Guide. You now have a clear roadmap. You will learn every step of the Digital Funding Process from start to finish.

Why a Digital Investment Platform Leads 2025 Fundraising

A strong Digital Investment Platform helps founders reach global investors fast. It removes location barriers and speeds up communication. It offers structured systems that help early founders stay organized.

You now compete with sharper startups. They already use digital tools to stay visible. You must understand this shift.

Digital Investment Platform Setup: First Steps for Founders

A modern Digital Investment Platform makes onboarding simple. Yet you still need clarity before uploading details. Start with these steps.

- Define your funding ask with clear logic.

- Build a crisp pitch deck.

- Prepare financial records with transparency.

- Create a digital profile with confidence.

This structure helps investors engage. Many founders also use a Startup Funding App to track investor actions and alerts.

Online Fundraising Guide Essentials: Documents You Must Prepare

Your Online Fundraising Guide must start with documents. You cannot skip this part. Investors review documents before calls.

Prepare these essentials:

-

- Pitch deck

- One-page overview

- Financial model

- Cap table

- Traction data

- Compliance certificates

Upload each file correctly on the Digital Investment Platform to maintain clarity. Use updated formats. Keep each file easy to read.

Digital Funding Process Structure: Step-by-Step Breakdown

The Digital Funding Process now follows a predictable path. You gain control when you understand this flow.

1. Profile Creation

Your Digital Investment Platform profile should communicate value quickly. Each section should reflect clarity.

2. Investor Discovery

You explore curated lists. Smart filters help you identify investors fast. Many Startup Funding App tools help refine matches.

3. Engagement

Investors show interest when your message is sharp. Use crisp outreach with strong logic.

4. Evaluation

Investors check numbers. They study your model. They review your story. Your clarity matters.

5. Compliance

Digital platforms guide documentation checks. This speeds up funding outcomes.

6. Closure

Once aligned, both sides close the deal through guided workflows.

Digital Investment Platform Comparison: Choose the Right Fit

Choosing the best Digital Investment Platform determines your speed. Look for these factors.

-

- Verified investor network

- Strong discovery filters

- Document vault

- Easy communication system

- Transparent dashboard

- Secure compliance flow

Your Online Fundraising Guide should help you compare features. Do not chase hype. Pick the tool that improves your reach.

Legal Compliance in the Digital Funding Process

Compliance protects you. Each Digital Funding Process includes legal checks. You must prepare these:

-

- Founders’ agreements

- ESOP structures

- Corporate records

- GST and PAN validation

- Equity terms

- Updated shareholder data

Upload all documents. Most platforms provide checklists. Legal clarity builds investor trust.

Timeline Expectations When Using a Digital Investment Platform

A strong Digital Investment Platform speeds up outcomes. Still, your timeline depends on clarity. Expect these timelines:

-

- 1 week to set up profiles

- 2 weeks to receive early responses

- 4–10 weeks to reach serious talks

- 6–16 weeks to close deals

This timeline improves with consistency. Slow responses delay outcomes.

Success Tips for Your Online Fundraising Guide Strategy

Follow these practical steps when using your Online Fundraising Guide:

-

- Update traction often

- Respond quickly

- Keep messages short

- Share real metrics

- Stay transparent during calls

Founders who follow structure gain more investor interest. Treat your Digital Funding Process like a system.

Digital Investment Platform Advantages for Modern Founders

A strong Digital Investment Platform gives powerful advantages:

-

- Fast investor discovery

- Structured pitch flow

- Real-time analytics

- Lower entry barriers

- Better visibility

- Consistent engagement

You gain more control. Your communication stays sharp. Your visibility increases through every step.

Where the Startup Ecosystem Moves in 2025

Digital tools dominate the 2025 landscape. Investors prefer structured profiles. Founders prefer predictable systems. The winning teams use insights wisely. You must treat digital tools as long-term partners. This mindset improves outcomes.

Why Founders Explore Platforms Like InvestHind Today

Many founders now explore platforms such as InvestHind. They want better visibility. They seek meaningful investor matches. They want smoother digital discovery.

InvestHind offers an ecosystem where verified investors and startups interact with trust. The structured environment increases confidence. Many founders feel curious when they notice the platform’s discovery-driven design. They explore deeper. They learn how visibility improves their chances. You may also find the platform useful if you seek structured digital growth.